To summarize, the present value (discounted cash flow) of $4,208.40 is the fair value of the $5,000 note at the time of the purchase. The additional amount received of $791.60 ($5,000.00 – $4,208.40) is the interest component paid to the creditor over the life of the two-year note. It only takes one mistake for your accounts to be thrown off completely.

Temporary Accounts Vs Permanent Accounts: How do Temporary Accounts Differ from Permanent Accounts

If the employee was part of the manufacturing process, the salary would end up being part of the cost of the products that were manufactured. By having many revenue accounts and a huge number of expense accounts, a company will be able to report detailed information on revenues and expenses throughout the year. An interest-bearing note payable may also be issued on account rather than for cash.

- Note Payable is credited for the principal amount that must be repaid at the end of the term of the loan.

- Generally, expenses are debited to a specific expense account and the normal balance of an expense account is a debit balance.

- You’ve already made your original entries and are ready to pay the loan back.

- At the end of that period, financial professionals include a closing entry, so the balance returns to zero.

- This is an owner’s equity account and as such you would expect a credit balance.

Financial Reporting

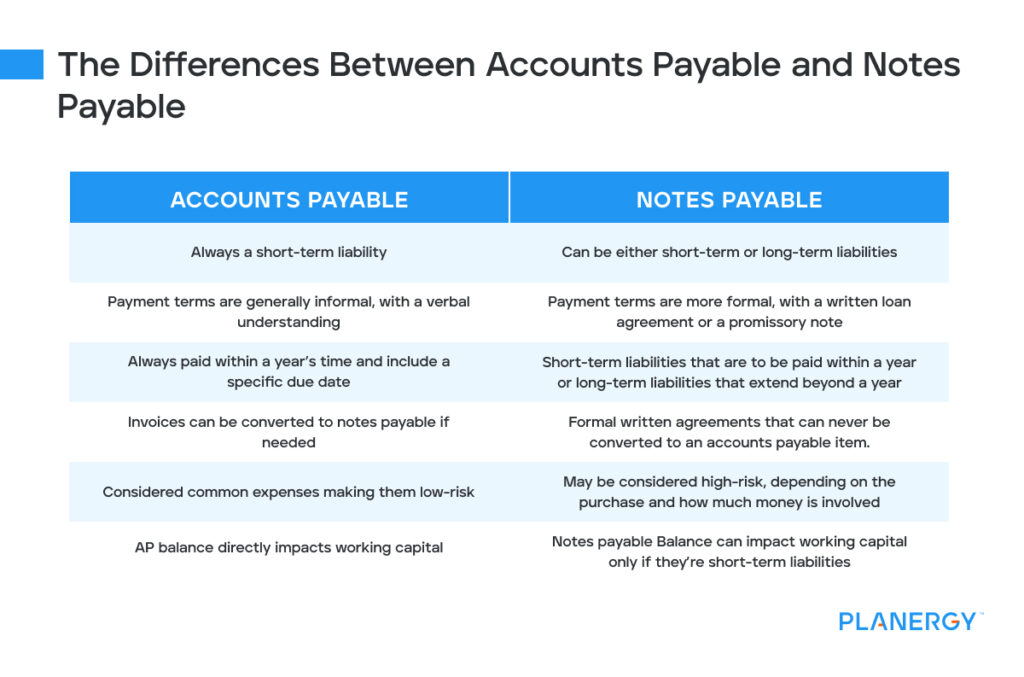

After compiling the totals from revenue and expense accounts, the net income or loss is transferred to retained earnings, and the income summary account is closed. Understanding the differences and critical roles of accounts payable and notes payable is essential for corporate accountants and financial managers. By properly managing these financial liabilities, businesses can better optimize their cash flows , maintain strong relationships with clients and reduce the risk of financial distress.

What is Revenue?

Here are some practical examples to illustrate the differences between the two. Notes Payable, on the other hand, represents a written promise by a company to pay a specific sum of money at a specified future date or upon the demand of the holder who received the note. It is typically used as a liability account to record a debt payback and is issued to banks, credit companies, and other lender. Accounts payable represents the amount a company owes its suppliers for goods or services purchased on credit. It is typically used in a company’s day-to-day operations and appears as a short-term liability on the balance sheet.

A small manufacturing company needs additional funds to expand its operations. It approaches a bank and takes out a $50,000 loan, agreeing to repay it with interest over three years. In this situation, the manufacturing company would record the $50,000 as notes payable, a liability account. This is because there’s a written promissory note detailing the loan terms and repayment schedule. When it comes to choosing between temporary vs permanent accounts, it’s not a matter of preference or choice but rather a necessity based on the nature of the transactions and the purpose of the account. Both accounts are integral parts of accounting systems and serve different purposes.

Permanent accounts refer to asset, liability, and capital accounts — those that are reported in the balance sheet. Under the accrual basis of accounting the account Supplies Expense reports the amount of supplies that is notes payable a permanent or temporary account were used during the time interval indicated in the heading of the income statement. Supplies that are on hand (unused) at the balance sheet date are reported in the current asset account Supplies or Supplies on Hand.

A review of the time value of money, or present value, is presented in the following to assist you with this learning concept. Secured notes payable identify collateral security in the form of assets belonging to the borrower that the creditor can seize if the note is not paid at the maturity date. So, at the end of a fiscal period, accountants note the closing balance, but they don’t close out the account by zeroing it out. Consequently, when the next fiscal period begins, the account continues with the closing balance it had from the previous fiscal period. In accounting, Permanent accounts carry a balance from one month to the next.

Understanding these terms and their implications are crucial for accurate financial reporting and decision making. This article will delve into what these accounts are, how they operate, and their impact on business accounting. Permanent — or “real” — accounts typically remain open until a business closes or reorganizes its operations.

However, they are not closed, and the accounts remain active throughout the life of the business. As a result, when the new accounting period begins, the account maintains the closing balance from the preceding period. A permanent account is recorded on a company’s balance sheet, which provides a snapshot of what the company owns and owes at a specific point in time.

At the end of an accounting period, the balance in a temporary account is not carried forward. Any remaining balance is then transferred to a permanent account, which typically involves the retained earnings on the balance sheet. This resets the temporary account balance to zero at the beginning of the next fiscal period. The information provided by both temporary and permanent accounts is critical for decision-making by management, investors, and other stakeholders.

Instead, they begin each period with a zero balance, accumulate data throughout the period, and then reset to zero at the end of the period. An equity account is a financial representation of business ownership accrued through company payments or residual earnings generated by an organization. Organizations use liability accounts to record and manage debts owed, including expenses, loans, and mortgages. A business owner can withdraw money for personal use with a drawing account. Sole proprietorships, partnerships, or S-corps typically use drawing accounts.

Recent Comments